40+ Debt payoff calculator with amortization

Loan Payoff Calculator to learn how much you can save in interest payments when you payoff your loan early. Enter your credit card balance.

Every Investor Should Know These 15 Credit Ratios Credit Balance Sheet Ratios That Allow Investors To Quickly Gauge A Com Balance Sheet Investing Management

Say you are taking out a mortgage for 275000 at 4875 interest for 30 years 360 payments made monthly.

. If you pay 500 in the month 450 will go to the principal and 50 to interest. To calculate your loans amortization there are a few details youll need. You decide to make an additional 300 payment toward principal every month to pay off your home faster.

Starting from the left we have Payment Number. Take Control Of Debt With A Best Egg Loan. It also determines out how much of your repayments will go towards the principal and how much will go towards interest.

Take Some of the Stress Out and Get Help Managing Debt. This loan calculator - also known as an amortization schedule calculator - lets you estimate your monthly loan repayments. Simply input your loan amount interest rate loan term and repayment start date then click Calculate.

You can see that the payment amount stays the same over the. Apply Now Payoff Your Debt. Early Payoff Amortization Schedule.

40 Accelerated debt payoff calculator excel Sabtu 03 September 2022 Edit. Enter payment amount per month. Ad Find Step-by-Step Assistance to Pay Your Debts with AARP Money Map.

See how early youll pay off your mortgage and how much interest youll save. 10000 car loan 265 payment 4. This debt amortization calculator will show you just how much money you could be saving by increasing.

Best Debt Consolidation of 2022. Enter the credit cards interest rate. This is the number of the payment that is made.

41 rows This amount would be the interest youd pay for the month. You can make extra payments each month or set a desire payoff year. The next months interest would be 05 9550 4775.

Accredited 501c3 Non-Profit Credit Counseling Agency 17520 West 12 Mile Road Suite 105 Southfield Michigan 48076 Toll. So if you are looking at a loan that you have made 10 payments so far you would be looking at Payment Number 10. Lets say your remaining balance on your home is 200000.

Date is also straight-forward. Use this amortization calculator to help you determine how many months it could take to pay off your loan with or without making extra payments. As a quick example if you owe 10000 at 6 per year youd divide 6 by 12 and multiply that by 10000.

Consolidate Debt Borrow Up To 50K With Fixed APRs. The amount is 05 10000 50. Conforming fixed-rate estimated monthly payment and APR example.

Are you having trouble paying off debt. Enter these values into the calculator and click Calculate to produce an amortized schedule of monthly loan payments. Number of payments over the loans lifetime Multiply the number of years in your loan term by 12 the.

Debt Payoff Calculator - Accelerated Debt Payoff Calculator - Mortgage Early Payoff Calculator - Excel Profit Calculator - Payoff. Your current principal and interest payment is 993 every month on a 30-year fixed-rate loan. Ad Well Help You Achieve Financial Freedom.

Ad Compare Best Debt Consolidation Companies of 2022. Payment Amount Principal Amount Interest Amount. A 225000 loan amount with a 30-year term at an interest rate of 3875 with a down payment of 20 would result in an estimated.

The answer is everything you would want to know about your debt payments. If your interest rate is 5 percent your monthly rate would be 0004167 005120004167. While the Amortization Calculator can serve as a basic tool for most if not all amortization calculations there are other calculators available on this website that are more specifically geared for.

Get accountability Ask a close friend or family member to call you once a month to ensure youre on track. This will help you track if your payments are in line with your plan. This is your principal or your total amount of borrowed debt.

Payment Date Payment Interest Paid Principal Paid Total Payment Remaining Balance. Create a payment schedule The Debt Reduction Calculator allows you to create a printable amortization schedule so you can track your progress. The length of your loan.

Enter desired months until debt free. Get Offers Payoff Your Debt.

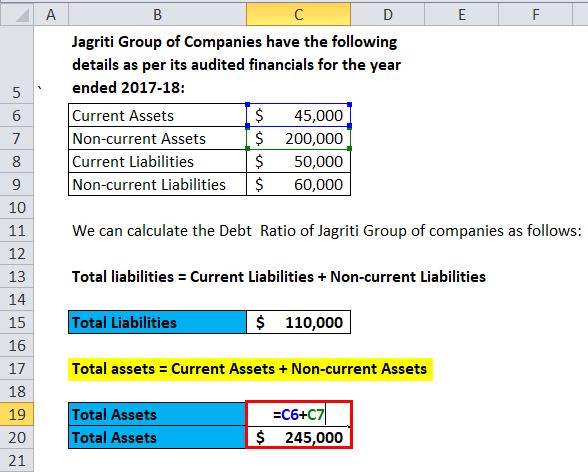

Debt Ratio Formula Calculator With Excel Template

Free Debt Snowball Worksheet Crush Your Debt Faster

Debt Snowball Can Pay Off 6 000 In 6 Months Here S How Debt Snowball Budgeting Money Saving Money Quotes

Payment Schedule Template Excel Beautiful 8 Printable Amortization Schedule Templates Excel Template Amortization Schedule Schedule Templates Schedule Template

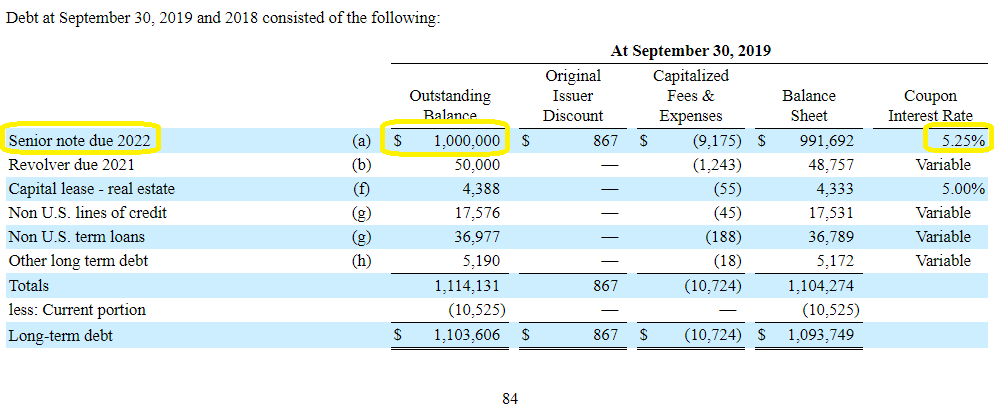

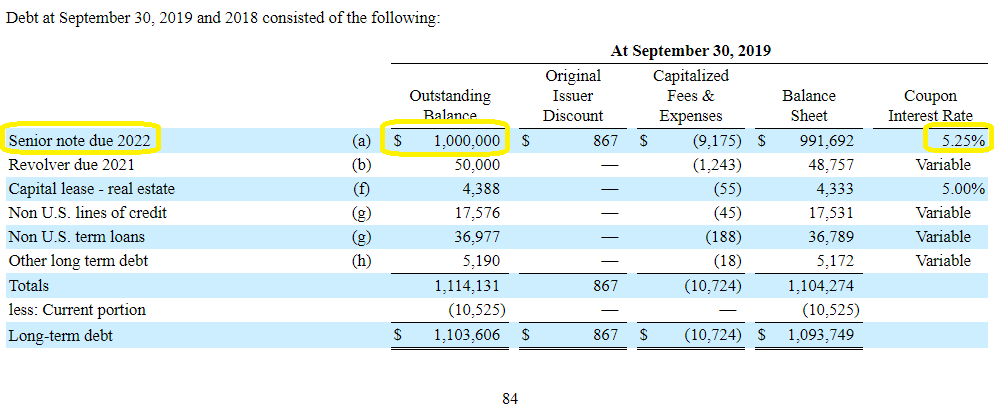

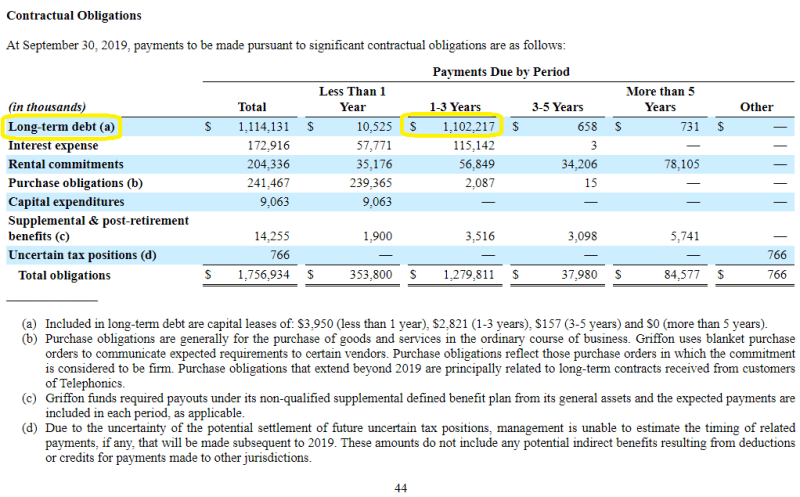

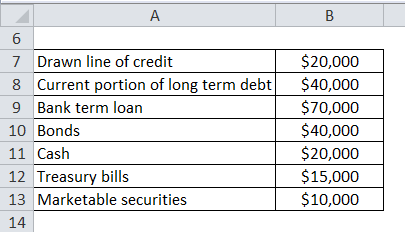

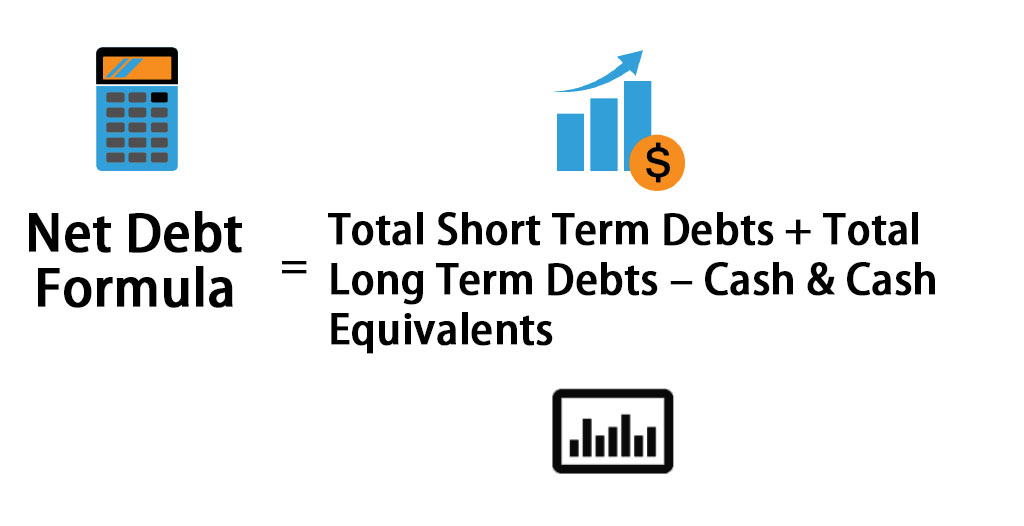

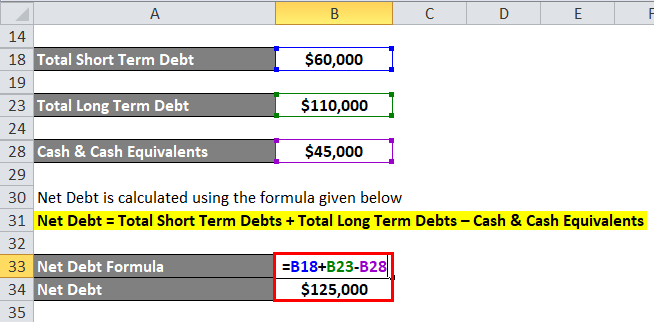

Net Debt Formula Calculator With Excel Template

Loan Amortization Schedule Calculatorhome Mortgage Etsy

Net Debt To Ebitda Guide Risk Valuation Examples And S P 500 Data

Tables To Calculate Loan Amortization Schedule Free Business Templates

Net Debt To Ebitda Guide Risk Valuation Examples And S P 500 Data

Tables To Calculate Loan Amortization Schedule Free Business Templates

Net Debt Formula Calculator With Excel Template

Debt Snowball Can Pay Off 6 000 In 6 Months Here S How Debt Snowball Budgeting Money Saving Money Quotes

Net Debt Formula Calculator With Excel Template

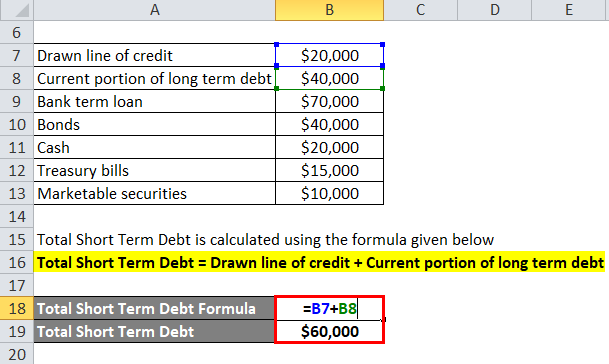

Debt To Income Ratio Formula Calculator Excel Template

Net Debt Formula Calculator With Excel Template

Tables To Calculate Loan Amortization Schedule Free Business Templates

Debt Ratio Formula Calculator With Excel Template